After a $10,000 cash outflow, the equipment is used in the operations of the business and increases cash inflows by $2,000 a year for five years. The business applies present value table factors to the $10,000 outflow and to the $2,000 inflow each year for five years. The average annual rate of return for the total stock market between 2013 and 2023, as measured by the growth of the S&P 500 index.

Do you own a business?

They are now looking for new investments in some new techniques to replace its current malfunctioning one. The new machine will cost them around $5,200,000, and by investing in this, it would increase their annual revenue or annual sales by $900,000. Specialized staff would be required whose estimated wages would be $300,000 annually. The estimated life of the machine is of 15 years, and it shall have a $500,000 salvage value. Simple rate of return is sometimes called the basic growth rate or return on investment.

Depreciation adjustment

Accounting Rate of Return is a metric that estimates the expected rate of return on an asset or investment. Unlike the Internal Rate of Return (IRR) & Net Present Value (NPV), ARR does not consider the concept of time value of money and provides a simple yet meaningful estimate of profitability based on accounting data. The time value of money is the main concept of the discounted cash flow model, which better determines the value of an investment as it seeks to determine the present value of future cash flows. On the other hand, consider an investor that pays $1,000 for a $1,000 par value 5% coupon bond.

- The accounting rate of return (ARR) is a simple formula that allows investors and managers to determine the profitability of an asset or project.

- If the question does not give the information, then use the average investment method, and state this in your answer.

- While it can be used to swiftly determine an investment’s profitability, ARR has certain limitations.

- Evaluating the pros and cons of ARR enables stakeholders to arrive at informed decisions about its acceptability in some investment circumstances and adjust their approach to analysis accordingly.

Does Rate of Return apply to other assets?

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Further management uses a guideline such as if the accounting rate of return is more significant than their required quality, then the project might be accepted else not. Any asset that has a cost to purchase and will produce income at some point in the future, from selling or otherwise, has a calculable rate of return. If there is no residual value you simply take the cost of the initial stp and finalisation investment and divide by two. One thing to watch out for here is that it is easy to presume you subtract the residual value from the initial investment. You should not do this; you must add the initial investment to the residual value. It is important that you have confidence if the financial calculations made so that your decision based on the financial data is appropriate.

It’s important to understand these differences for the value one is able to leverage out of ARR into financial analysis and decision-making. The Accounting Rate of Return is the overall return on investment for an asset over a certain time period. It offers a solid way of measuring financial performance for different projects and investments.

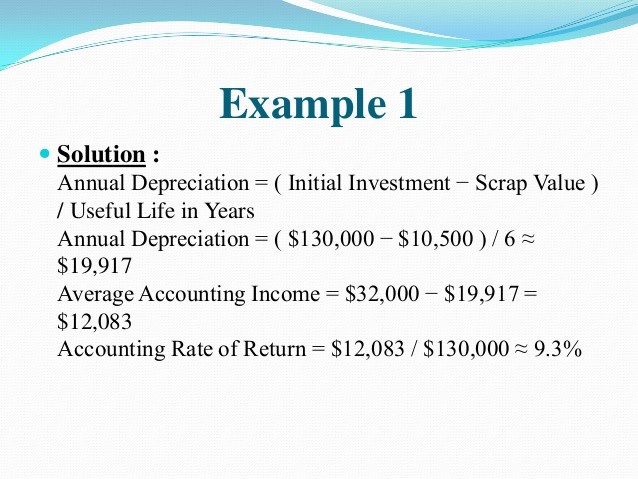

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The Accounting Rate of Return can be used to measure how well a project or investment does in terms of book profit. Accounting Rate of Return is calculated by taking the beginning book value and ending book value and dividing it by the beginning book value. The Accounting Rate of Return is also sometimes referred to as the “Internal Rate of Return” (IRR). We are given annual revenue, which is $900,000, but we need to work out yearly expenses.

The rate of return (ROR) is a simple to calculate metric that shows the net gain or loss of an investment or project over a set period of time. The Internal Rate of Return (IRR) and the Compound Annual Growth Rate (CAGR) are good alternatives to RoR. IRR is the discount rate that makes the net present value of all cash flows equal to zero. CAGR refers to the annual growth rate of an investment taking into account the effect of compound interest. A rate of return (RoR) can be applied to any investment vehicle, from real estate to bonds, stocks, and fine art. The RoR works with any asset provided the asset is purchased at one point in time and produces cash flow at some point in the future.

While it can be used to swiftly determine an investment’s profitability, ARR has certain limitations. The accounting rate of return (ARR) is an indicator of the performance or profitability of an investment. The RRR can vary between investors as they each have a different tolerance for risk. For example, a risk-averse investor requires a higher rate of return to compensate for any risk from the investment. Investors and businesses may use multiple financial metrics like ARR and RRR to determine if an investment would be worthwhile based on risk tolerance.

However, the formula does not consider the cash flows of an investment or project or the overall timeline of return, which determines the entire value of an investment or project. Average accounting profit is the arithmetic mean of accounting income expected to be earned during each year of the project’s life time. Average investment may be calculated as the sum of the beginning and ending book value of the project divided by 2. Another variation of ARR formula uses initial investment instead of average investment. This simple rate of return is sometimes called the basic growth rate, or alternatively, return on investment (ROI). If you also consider the effect of the time value of money and inflation, the real rate of return can also be defined as the net amount of discounted cash flows (DCF) received on an investment after adjusting for inflation.