The accounting rate of return is a capital budgeting metric to calculate an investment’s profitability. Businesses use ARR to compare multiple projects to determine each endeavor’s expected rate of return or to help decide on an investment or an acquisition. Accounting rate of return (also known as simple rate of return) is the ratio of estimated accounting profit of a project to the average investment made in the project. The internal rate of return (IRR) also measures the performance of investments or projects, but while ROR shows the total growth since the start of the project, IRR shows the annual growth rate.

Ease of calculation

However, in the general sense, what would constitute a “good” rate of return varies between investors, may differ according to individual circumstances, and may also differ according to investment goals. Accounting Rate of Return helps companies see how well a project is going in terms of profitability while taking into account returns on investments over a certain period. Accounting Rates of Return are one of the most common tools used to determine an investment’s profitability. It can be used in many industries and businesses, including non-profits and governmental agencies. The accounting rate of return (ARR) is a financial ratio of Average Profit to the Average Investment made in the particular project.

Depreciation Calculators

- Find out everything you need to know about the Accounting Rate of Return formula and how to calculate ARR, right here.

- A closely related concept to the simple rate of return is the compound annual growth rate (CAGR).

- We are given annual revenue, which is $900,000, but we need to work out yearly expenses.

- The accounting rate of return is a capital budgeting metric to calculate an investment’s profitability.

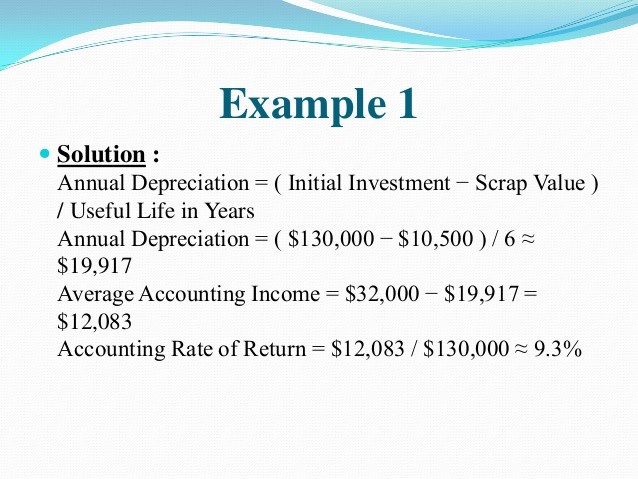

ARR takes into account any potential yearly costs for the project, including depreciation. Depreciation is a practical accounting practice that allows the cost of a fixed asset to be dispersed or expensed. This enables the business to make money off the asset right away, even in the asset’s first year of operation. The calculation of ARR requires finding the average profit and average book values over the investment period.

Real Rate of Return vs. Compound Annual Growth Rate (CAGR)

The rate of return, or RoR, is the net gain or loss on an investment over a period of time. You have a project which lasts three years and the expected annual operating profit (excluding depreciation) for the three years are $100,000, $150,000 and $200,000. The decision rule argues that a firm should choose the project with the highest accounting rate of return when given a choice between several projects to invest in. The main difference is that IRR is a discounted cash flow formula, while ARR is a non-discounted cash flow formula. However, the formula doesn’t take the cash flow of a project or investment into account. It should therefore always be used alongside other metrics to get a more rounded and accurate picture.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. AMC Company has been known for its well-known reputation of earning higher profits, but due to the recent recession, it has been hit, and the gains have started declining. ARR can be problematic in that it is subject to accounting policies which will vary from one organization to another and can be subject to manipulation.

The main difference between ARR and IRR is that IRR is a discounted cash flow formula while ARR is a non-discounted cash flow formula. ARR does not include the present value of future cash flows generated by a project. In this regard, ARR does not include the time value of money, where the value of a dollar is worth more today than tomorrow.

The Compound Annual Growth Rate (CAGR) is another metric that shows the annual growth rate of an investment, but this time taking into account the effect of compound interest. A closely related concept to the simple rate of return is the compound annual growth rate (CAGR). The CAGR is the mean annual rate of return of an investment over a specified period of time longer than one year, which means pricing and charging the calculation must factor in growth over multiple periods. To find this, the profit for the whole project needs to be calculated, which is then divided by the number of years for which the project is running (in this case five years). As we can see from this, the accounting rate of return, unlike investment appraisal methods such as net present value, considers profits, not cash flows.

Accounting Rate of Return, shortly referred to as ARR, is the percentage of average accounting profit earned from an investment in comparison with the average accounting value of investment over the period. Every business tries to save money and further invest to generate more money and establish/sustain business growth. If you run your own business, are responsible for the financial elements of a product or product design or a project manager, remember that your profits are secure only if the investments are based on accurate financial analysis. ARR for projections will give you an idea of how well your project has done or is going to do. Calculating the accounting rate of return conventionally is a tiring task so using a calculator is preferred to manual estimation.

As the ARR exceeds the target return on investment, the project should be accepted. HighRadius Autonomous Accounting Application consists of End-to-end Financial Close Automation, AI-powered Anomaly Detection and Account Reconciliation, and Connected Workspaces. Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.